Ensure you click calculate after you make changes.Use the Advanced Tax Calculator to edit your refundable and non-refundable tax credits.Gross Yearly Cafeteria or other pre-tax planġ Do not include yourself or your spouse. Gross Yearly Tax-Deferred Retirement Plan Your Tax Status &Family Please select all that apply Your Expenses in detail (F1040 L23-35) Educator expensesĬertain business expenses of reservists etc

Your Income in detail (F1040 L7-21) Wages, salaries, tips, etc.ġ Line 20a not included in Gross income, See Social Security Benefits calculation for calculation on line 20b as part of Taxable income *** Please Enter your Yearly Gross income.

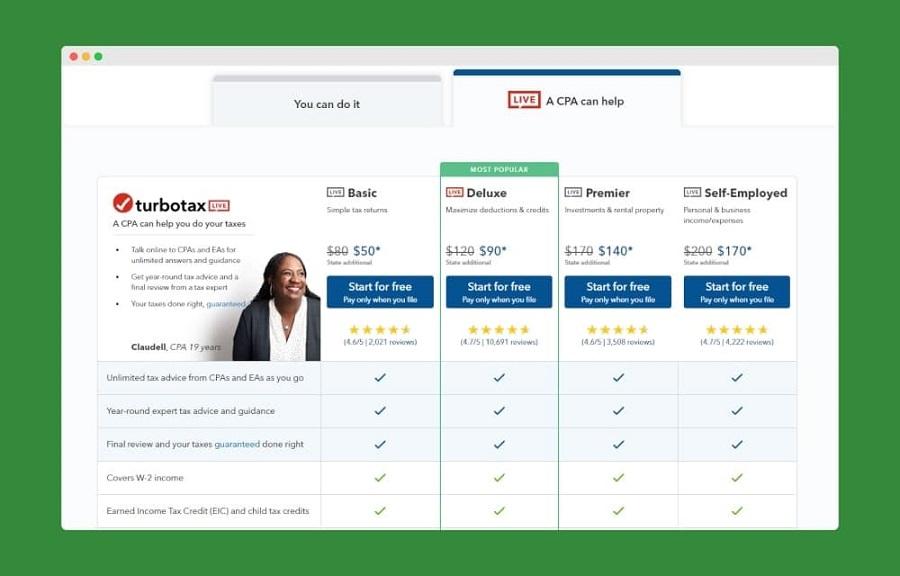

#Turbotax return estimator free#

The Tax calculator is free to use, our only request is that you provide feedback if you spot an error and share on your favourite social media platform to help other make use of this tool. The Federal Tax Calculator below is updated for the 2022/23 tax year and is designed for online calculations including income tax with Personal allowance (refundable &non-refundable tax credits), Federal Tax, State Tax, Medicare, Social Security and Yearly Income Tax deductions, we also have State Tax calculators available for each state. The tax calculator uses 2022 State tax tables as default.

If you wish to calculate your tax return for a previous tax year, select historic tax years from the dropdown menu. You can calculate and estimate your 2022/23 tax return simply by entering your annual salary. Welcome to the Tax Form Calculator, the free online calculator for Federal Tax and State Tax Calculations.

0 kommentar(er)

0 kommentar(er)